|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Subprime Mortgage Refinance Loan Lenders: A Comprehensive GuideIntroduction to Subprime Mortgage RefinancingSubprime mortgage refinance loan lenders provide refinancing options to borrowers with less-than-perfect credit scores. These loans typically carry higher interest rates, compensating for the increased risk the lender assumes. Understanding how these loans work and their potential impact on your financial health is crucial. How Subprime Mortgage Refinancing WorksRefinancing a subprime mortgage involves replacing your existing loan with a new one, ideally under better terms. This process can help reduce monthly payments or lock in a lower interest rate. However, borrowers should be aware of potential pitfalls, including prepayment penalties and additional fees. Steps Involved in Subprime Refinancing

Benefits and Risks of Subprime Mortgage Refinancing

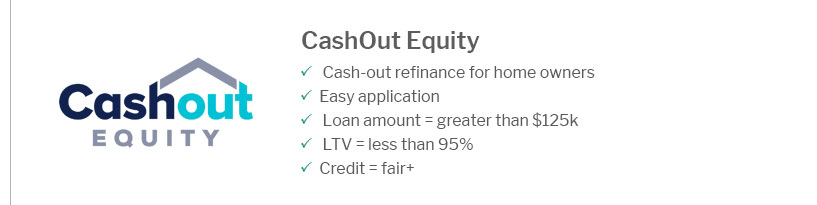

For those considering a cash-out option, a home refinance calculator with cash out can be a valuable tool in assessing the feasibility of this strategy. Finding the Right LenderChoosing the right lender is crucial for securing favorable loan terms. Borrowers should consider factors such as the lender's reputation, customer service, and the variety of loan products offered. Exploring options like home point financial refinance can be a good starting point. FAQWhat is a subprime mortgage refinance loan?A subprime mortgage refinance loan is a refinancing option for borrowers with low credit scores, offering new loan terms in exchange for the existing mortgage. Who qualifies for subprime refinancing?Typically, individuals with a credit score below 620 may qualify for subprime refinancing, though specific criteria vary by lender. Can refinancing save money in the long run?Yes, refinancing can save money by securing lower interest rates or more favorable loan terms, reducing overall costs over time. https://www.huduser.gov/portal/datasets/manu.html

First, subprime lenders typically have lower origination rates than prime lenders. Second, home refinance loans generally account for higher shares of subprime ... https://www.newsweek.com/rankings/americas-best-online-lenders-2024/bmrl-sub-prime

America's Best Online Lenders 2024 ; AmeriSave, Best Mortgage (Refinance) Lenders for Subprime Borrowers 2024 ; loanDepot, Best Mortgage (Refinance) Lenders for ... https://migonline.com/bad-credit

If your FICO score is less than 600, it may be difficult for lenders to give you a home loan; but this does not mean you cannot get a mortgage.

|

|---|